IF YOU'RE READING THIS

There is a likelihood that you want to become a better

trader or you lost a lot of capital recently and have

decided to get better.

축하한다, 당신은 이미 좋은 길로 들어섰다.

어떻게 하든간에 손해는 발생할 것이다,

하지만 당신에게 능동적인 손해를 예방하는 계획이 없다면

당신은 자본을 모두 잃을 것이다.

"...note that none of it its ever carved in stone. I firmly belive,

though, that the more a trader adheres to a strict set of entry

and exit rules, the less likely he is to fall prey to the challenges

of the emotional kind." - J. Murphy

The difference between a skilled trader and a profitable trader is that the

profitable trader has the skills and the humility to learn from the losses.

Murphy emphasizes on STRICT and Set Entry and Exit.

그리고 감정이야말로 트레이딩의 가장 큰 적이라고 말했다.

많은 사람들은 얘기한다.

"투자에는 감정이 필요하지 않다"

근데 감정이란 무엇일까?

Examples below:

1. Hoping for price to go up or down.2. Hoping for price to reverse.3. Listening to others who have the same opinion has you to assurance.

Hope in trading is the emotion.

Skills are easy, using skills to generate

profit is difficult.

나의 트레이딩 시스템은 좋았지만 나는 내 자본을 계속해서 잃고 있었다. The same experience was faced by salsa tekila as he has many times described.

사실은 만약 당신이 양을 키우고 있다면 늑대들이 반드시 당신을 공격하러 올 것이다. 그러한 공격에 살아남을 수 있는 시스템을 가져라.

I have lost my Capital a lot of times and there's nothing nice about losing 70-80% of your Capital or life savings for fun.

존버란 추세에 반하여 홀딩하는 것이 아니라, 존버란 추세 안에서 홀딩하고 적절한 타이밍에 구매하는 것을 말한다. 당신의 진입 가격과 시간이 추세를 결정한다. 추세란 당신의 진입시점과 상관없는 마켓 싸이클을 의미한다.

예를 들어, 당신이 비트코인을 100달러에 샀다면, 애초에 생각할 필요가 없다. 하지만 당신이 비트코인을 40-50k에 샀다면, 결정할 것들이 몇개 있다.

If you agree that you don't want to lose 80-90% of your Capital in the HOPE to breakeven after 3-4 years, then read on.

Please know that I am trying to describe a lot of topics that Welle Wilder Jr. has tried to describe, but I will try to describe it in a simpler manner.

You will get alot of question while reading the following and a lot of it will not make sense and you'll start questioning the teachings of Larry R. Williams, but still with it, you will get it all in the end.

Remember, when you hold a position in 80% Loss for 4-5 Years:

1. You're holding an asset that MAY never get to your breakeven point.E.g. Many People bought XRP at 3.30 dollar and are still waiting for about 4 years to hit a break-even.

2. You're holding an asset which you can ONLY HOPE to get back to your breakeven.

3. There's no guarantee if your price will come back to those levels.

위의 내용들은 너무 가혹하게 들릴 수 있지만, 당신이 밝은 면을 볼 때, 이는 더 명확해질 것이다.

아래 질문에 대답하라:어떤 것이 당신에게 맞다고 느껴지는가?

- 90퍼센트의 하락을 겪은 자산을 4-5년 홀딩해 900퍼센트의 펌핑을 바라며 본절이 오는 것(90퍼센트의 하락은 900퍼센트의 펌핑이 있어야 본전이다.)

- 리스크를 관리하고 약간의 돈만 잃음으로써 위의 고통을 겪지 않고 다른 트레이드를 찾는 것.

사람들이 가장 자주 묻는 질문:'왜 손해일 때 팔아야하죠?''가격이 반전될 수 있는데 왜 팔아야하죠?'

두가지 질문 모두 타당하지만 여기에 답을 주겠다- but to answer the question, "Why should we sell when the price can reverse?" consider another question:

"WHY SHOULD WE NUY IF THE PRICE CAN REVERSE?"

Shouldn't the question be valid for both directions?

Here is what John Muphy has to say about having an exit plan.

무효화 지점을 가져라. 그것을 바꾸지마라. Moving them, wishing for something else upon reaching them will lead to further misery. This is an expensive lesson if not learnt. Please read the above paragraph by Murphy very carefully.

Cutting losses doesn't mean selling, cutting losses means exiting when the market structure Changes.

이것을 기억하라: 만약 시장 구조가 바뀌었을 때도 당신의 트레이딩을 바꾸지 않는다면, 당신은 파도를 거슬로 타는 것이다.

Hence the need for change in direction of trading, cutting losses arises once the market structure Changes.

This is the sole and the only reason to cut losses, Change in Market structure.

많은 사람들이 시장 구조를 다르게 정의한다. Some people define it as the formation of higher highs and higher lows for a bullish trend.

Foration o flower lows and lower highs in a bearish trend.

Here is an example of new lows being formed in a market structure.

Howsoever you define it, the truth is that you're defining a range to define a market structure. 가격이 올라가든 내려가든 횡보하든, 가격은 항상 패턴 즉 레인지 안에 존재한다.

아래에 수평 레인지의 예를 보자.

자 위로부터 우리가 낼 수 있는 결론은:

1. Market always forms a structure, it could be not obvious but it's evident.

2. Trading in the same direction when the market structure change is not wise.

3. Market Structure can be formed by price forming HH and or LH and LL or a constant sideways movement.

When should you enter a trade?

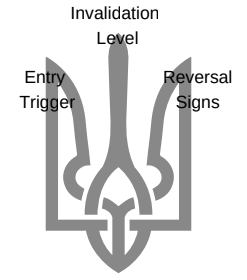

The trading trident: ONly enter when you have a clear "Trading Trident"

1. Entry Triggers as per your trading technique

2. Established invalidation levels(Stop loss)

3. Defined reversals (Profit taking)

Lary Williams said that it's not important to buy the bottom or sell the top, but always know where and when to exit. PLEASE keep in mind that all of these statements are true for both Long and Short entries.

The premise of entering a trader is always, always at the rang low or high.

This applies for BOTH long and short trade.

Ranges can occur on ANY time frame, from weeks to seconds.

Don't enter at the middle of a range.

What to look for?

Look for confluence.

Confluence means more than one condition in favour of a trade.

This is where you enter on getting any kind of volume support.

The confluence can be of Volume Area High, POC, Fibs, horizontal supports or any other confluence.

We will learn about Volume Area High, POC in volume profile.

How much should you enter with?

This is the most importatnt part and please read this very carefully.

How much you should enter with always should be a constant percentage of you Capital. E.g. 3%

Many authors suggest 1% per trade but let's stick to 3% for example.

You might think, WHY should I trade with just 3%?

3% is the amount of Risk you're putting in.

Your position size will depend on WHERE THE INVALIDATION level is.

To re-iterate, let's say you have 100K dollars and choose to risk 3%.

Tha's 3K Dollars.

IF your invalidation point allows you to have a 25x leverage, you can trade with a position size of 75K Dollars.

So the trading size that we enter is 75K, risking just 3K.

Even if the worst situation arises, given if we're in an isolated position, we WILL ONLY LOSE 3% instead of 70-80% AND still trade with such big position size.

I know a lot of you still have a lot of questions but keep reading, it will be answered.

Choosing Position

How to choose the position size or the leverage? and WHY only risk 3%?

Choosing position size depends on the invalidation point, i.e. at what point the market structure change and the market will change its movement structure.

An invalidation level is where the market structure for the trade could potentially change. Remember, you trade in the direction of the market structure.

Market structure Changes, the trade should end. Simple?

The positioning of invalidation level depends on how you interpret the market

Here we will try to understand the same in charts.

'EmperorBTC > Other threads' 카테고리의 다른 글

| BITCOIN PRICE REPORT (0) | 2021.10.20 |

|---|---|

| Trend reversal short setup (0) | 2021.10.20 |

| Scalping Tips (0) | 2021.10.20 |

| Retracement vs. Reversal (0) | 2021.10.20 |

| Quick look at Indicator confirmations (0) | 2021.10.19 |